In recent months, the S&P 500 has been making new highs. At the same time, most American companies from various sectors were in the red. What is it connected with and what to expect, understood The Bell.

Who pushes the index up

There have been no corrections in which the market fell more than 10% from highs in the US since March 2020. But the market is getting tighter: the index is being pushed up by a few high-priced companies like Amazon and Tesla, and 84% of S&P 500 companies are trading below their highs as of Nov. 8.

As a result, the concentration of the US stock market in October reached a record level since the 1980s. The top 10 most valuable companies in the S&P 500 index, which increasingly include Tesla and Nvidia, accounted for 30.3% of the entire index’s capitalization, according to JPMorgan estimates at the end of October. This is a record since at least 1996.

An obvious consequence of such concentration is the dependence of the dynamics of the index on several issuers. Excluding Berkshire Hathaway and JPMorgan, which round out the top 10, these are all fast-growing companies valued above the market: the average P/E of the top 10 S&P 500 companies at the end of October was 32.2, compared to 21.4 in of the index as a whole is data from JPMorgan.

The high valuations of FAAMG (Facebook, Apple, Amazon, Microsoft, Alphabet), which account for about 23% of the index’s capitalization but only 17% of expected returns in 2022, are justified by their strong past performance and higher than medium-term expectations for of the future.

But this makes them (and therefore the entire index) more vulnerable to changes in expectations. The main risk for FAAMG is lower-than-expected revenue growth. And this has already happened in history and is known to everyone as the collapse of the dotcom bubble.

Morgan Stanley strategists attribute the narrowness of the current market to the influx of funds from passive investors – index ETFs, mutual funds, some large investors, as a result of which liquidity is redistributed to the benefit of already expensive companies. Passive funds are becoming increasingly influential – and this is changing the markets.

The rise of passive investments

In 2021, we can confidently talk about the “index revolution” as a fact that has happened. According to Bloomberg Intelligence, in March 2021, passively managed funds accounted for 42.9% of all assets (about $10 trillion) of all funds. For comparison, in 1995 this figure was 3%, in 2005 it was 14%.

At this rate, passive funds will surpass active funds in the volume of funds under management within five years. The three pillars of passive investing — BlackRock, State Street and Vanguard — today collectively own 20% of all companies in the S&P 500 index, The Economist wrote in October.

Index funds obviously attract investors with low fees (for example, in the Vanguard Large-Cap ETF, it is 0.04% per year of invested funds compared to 1-2% plus performance fees in active funds) and the non-obvious advantage of active Management: Over the last 10 years of the continuous bull cycle, 82.5% of managers have underperformed the market in return to investors after fees. In a less stable market in the 2000s, managers mostly beat index funds.

Passive investing is changing the market

Passive investing empowers indices, but market concentration is just one of the consequences. Investing on the basis of indices – that is, without analyzing specific issuers – also leads to the fact that the markets become excessively overvalued, argues Vincena Delouard of the brokerage firm StoneX.

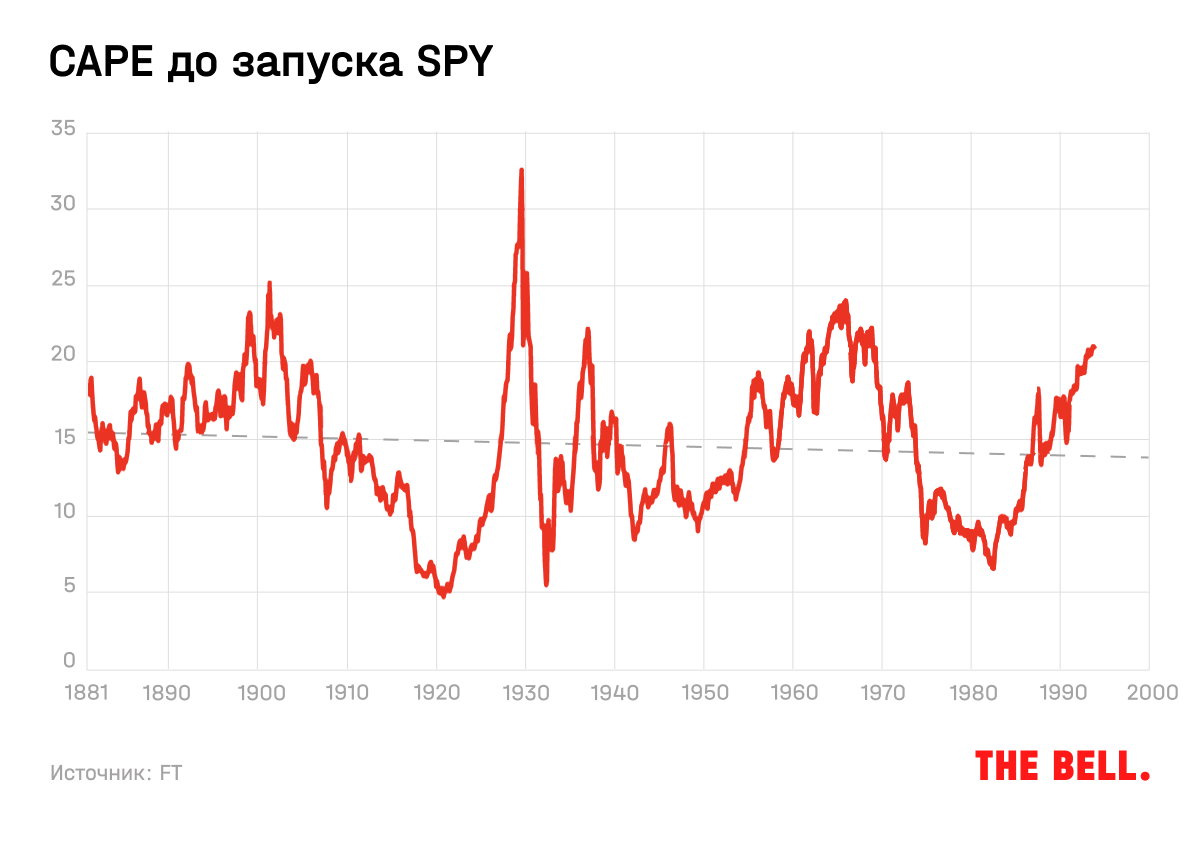

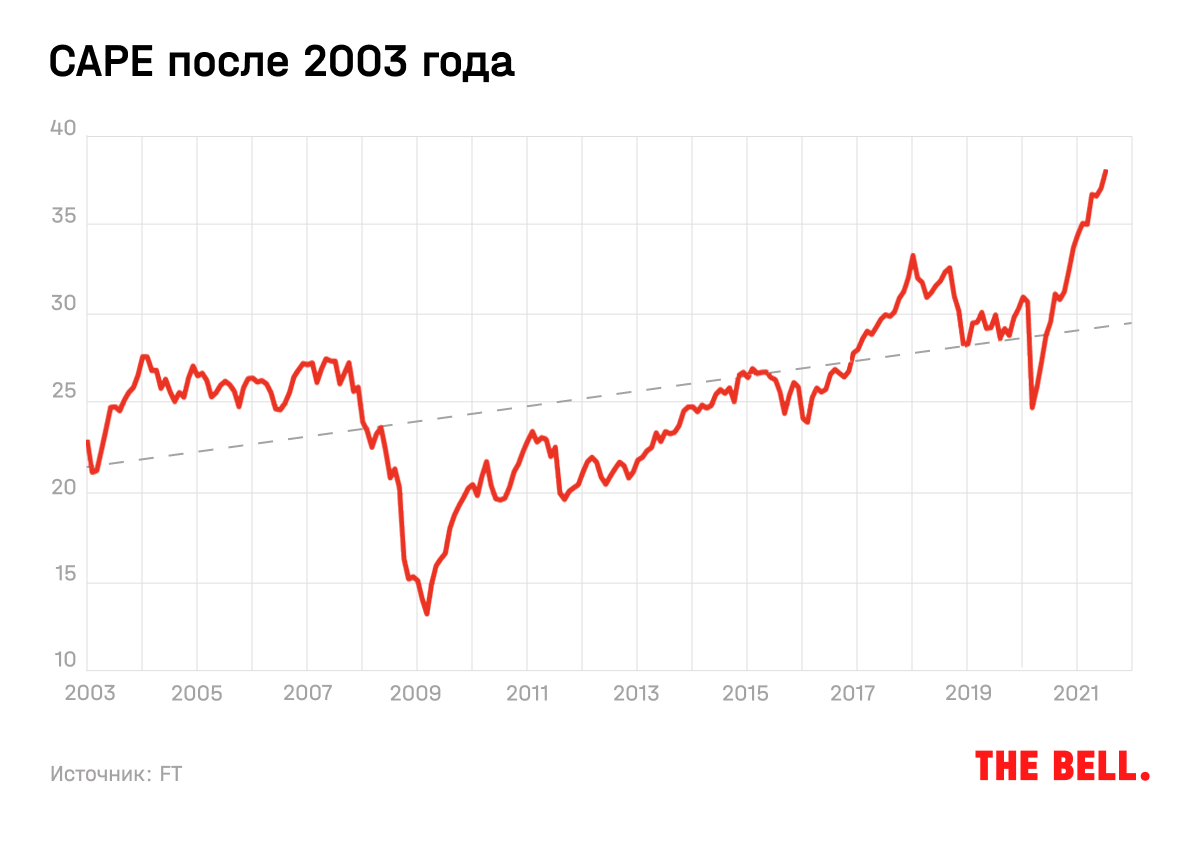

For the calculation, he took the cyclically adjusted Shiller index (CAPE) – the ratio of price to 10-year average earnings. Such normalization allows you to smooth out fluctuations in profits due to business cycles. Between 1881 and 1993, when the first S&P 500 ETF was launched, the trend CAPE hardly changed.

But starting from 2003, there is a noticeable upward trend in the CAPE indicator to the current record levels. Passive investing, according to Deluard, is responsible for the 27% increase in CAPE relative to historical averages, with the rest of the responsibility being the ultra-loose monetary policy of central banks.

Passive investing rewards great growth companies at the expense of undervalued value companies, says Delouard. Historically, this is not the norm: markets have previously given a premium to small-cap and value stocks, the expert notes.

As a result, investors get the picture described at the beginning of the article: valuations of companies increasingly diverge from fundamentals, the number of corrections in the markets decreases, and they become shorter because they are bought by passive investors.

But this leads to the inflation of bubbles, while the dynamics of stock indices are less and less related to the economic situation. According to Deluard’s calculations, the same pattern is observed in the USA: the greater the share of passive investors, the more expensive the market is according to the price to sales (P/S) indicator. Index investing is also actively growing in Europe, writes FT.

Another area of concern for investors is corporate governance. Passive funds investing in hundreds if not thousands of companies don’t care about it, unlike active investors, notes The Economist. According to the forecast, within 20 years, BlackRock, State Street and Vanguard will acquire 40% of all votes in companies from the S&P 500 index.

As a result, the growing influence of passive investors may weaken one of the main functions of stock markets – providing capital and ensuring the growth of quality issuers, the OECD report said. In theory, this could contribute to the growth of zombie companies.

As index funds gain strength, volatility may increase, according to research published on the Fed’s website. Sharp movements in the markets in recent years have really been happening more often, and this is particularly related to passive investing, writes Bloomberg with reference to Bank of America and Societe Generale.

How to be an investor

Passive investing changes the market and, as many investors believe, not for the better – making it less rational and more difficult to analyze. Some, like Delouard, believe that it causes bubbles to grow (recognizing that central banks are largely responsible for it). But even those who talk about the dangers of index funds do not oppose them – their advantages are now too great for many private investors.

The rise of passive investing is yet another proof that ideas matter. And this should be taken into account by investors in their decisions.

1. Warren Buffett advised most retail investors to invest in index funds. But if you follow this advice, your portfolio will depend more on overvalued companies.

For example, according to data on November 24, the largest weight in the Russell 2000 index of small-cap companies was held by the “meme” shares of the cinema chain AMC and Avis Budget Group. The car rental service caught the attention of private investors after the company announced plans to add electric vehicles on Nov. 2, sending its stock more than doubling that day. GameStop, which became a meme back in January, has increased in price 11 times since the beginning of the year: the company is now worth about $16 billion and ranks 16th in weight in the S&P Mid Cap 400 index.

Not surprisingly, most managers — more so than private investors who shun “meme” stocks — underperform the benchmarks. For the same reason, October was a terrible month for managers when comparing their returns to the market average: Tesla shares, which many prefer not to buy, rose 44%.

But passive funds can’t remove, say, Tesla, Nvidia, or AMC from their portfolios if they’re included in the indexes they track. And active ones can. For example, star manager Joel Tillingast of Fidelity Investments, who used to be GameStop’s largest shareholder, now doesn’t own any of their stock. Michael Burry’s Scion Asset Management and John Broderick’s Permit Capital sold all papers during the peak of the hype around Gamestop.

2. Even if you use only fundamental indicators in your analysis, you need to consider the premium that the inclusion of the company in the index gives due to the inflow of funds from passive investors. Logically, this leads to the company becoming increasingly overvalued.

Investors looking for undervalued companies, the same Delouard recently advised to pay attention to papers that are not included in the indexes, for example, shares of companies from the “old school” industries: energy and tobacco production. The discount embedded in their value will be realized, if not within a few months, but definitely on the horizon of decades, he is sure. The only question is whether anyone is willing to wait that long in the age of Tesla and Reddit.