Electricity prices in European countries rose significantly in June, the highest in Ukraine.

In June, Ukraine imported 858.4 thousand MWh of electricity, which is 6% more than was purchased for the whole of 2023. At the same time, the weighted average price of purchase and sale of electricity according to the data of the “Market Operator” in June of this year increased by 27.9%.

The situation in Europe

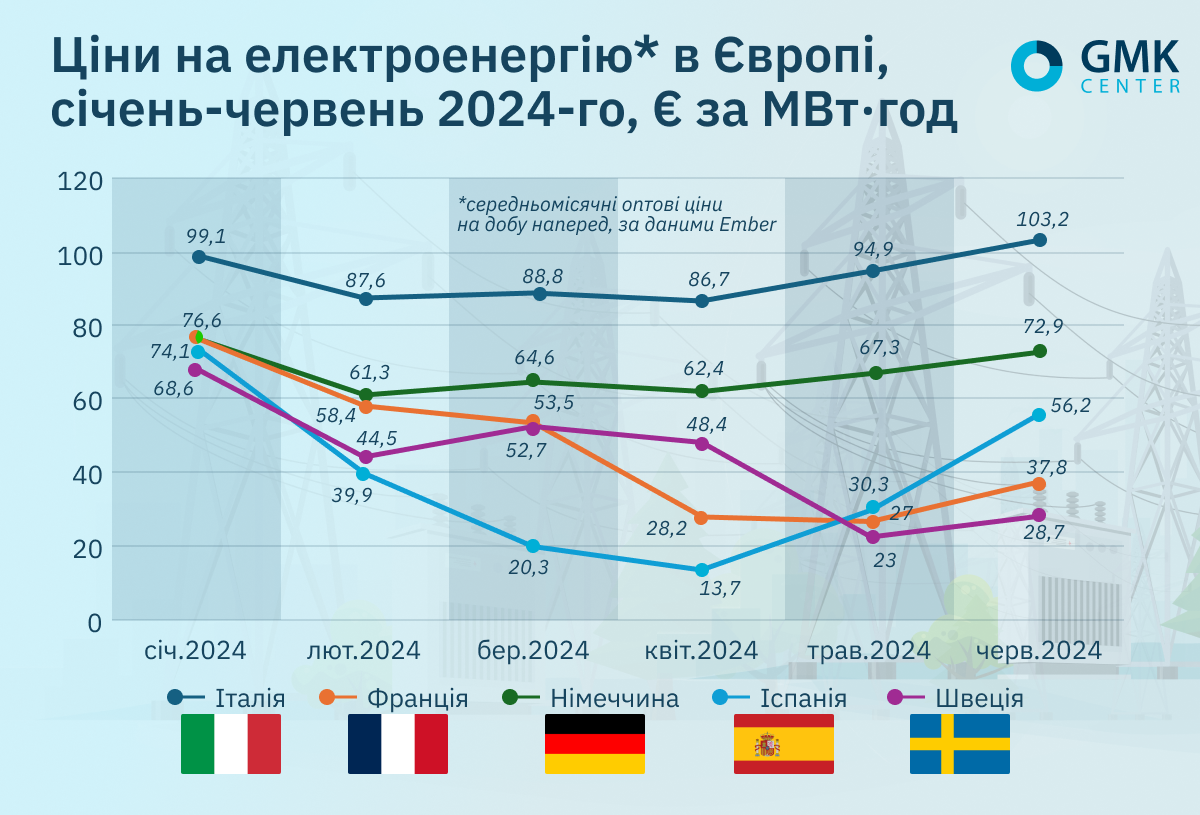

In the EU, the average monthly wholesale electricity prices for the day ahead in June 2024 increased significantly compared to May. According to Ember, they were:

- Italy – €103.2/MWh (+8.7% m/m);

- France – €37.8/MWh (+39.4%);

- Germany – €72.9/MWh (+8.3%);

- Spain – €56.2/MWh (+ 85.5%);

- Sweden – €28.7/MWh (+24.7%).

The reasons for the increase in prices were an increase in demand in the second half of the month due to an increase in average temperatures, a drop in the volume of wind generation and instability of solar during the month, fluctuations in gas prices and CO2 emissions.

At the same time, half-year solar production was the highest on record across all markets. In some cases, wind power has also reached this milestone.

“By the end of the year, a seasonal rise in electricity prices is expected in Europe, judging by the forward curve. For example, in Germany, price growth may reach 15% by the end of 2024. In general, the situation in the European energy market is very volatile due to the delicate balance of the gas market. But Europe is ready for this, unlike Ukraine,” notes chief analyst of GMK Center Andriy Tarasenko.

The situation in Ukraine

In Ukraine, the weighted average price of buying and selling electricity on the day-ahead (day-ahead) market, according to the Market Operator, in June of this year increased by 27.9% month-on-month, amounting to UAH 5,403.38/MW h (€124.9/MWh at the exchange rate of UAH 43.26/euro), which is almost 16% more than the maximum average price in the EU in the same period.

According to Energy Map, in June Ukraine imported 858.4 thousand MWh of electricity, which is 6% more than was purchased for the whole of 2023 (806.4 thousand MWh). In addition, this is the largest monthly volume of imports in the last 10 years. Compared to May, imports have increased almost twice, since June 2023 – almost twenty times. The largest volume of electricity last month was imported from Hungary.

At the beginning of July, representatives of large Ukrainian MMC companies called on the government to reconsider the decision to increase the share of electricity imports to 80% for the stable energy supply of enterprises. The business considers setting this norm at the level of 50% to be a compromise solution. Otherwise, the high price of imported electricity will lead to a reduction in production, since the cost of electricity constitutes a significant part of the cost of production. The Ministry of Energy, in turn, declares the impossibility of such a step due to a significant deficit in the energy system, and suggests that businesses build their own generation.

“The need to import electricity in Ukraine has led to the fact that local prices are higher than European ones. More than 90% of steel in the EU is produced in countries that have an advantage in energy prices compared to Ukraine. The energy-intensive domestic economy can suffer colossal losses,” Andriy Tarasenko notes.

Renewable energy

Last month, a number of organizations representing energy-intensive industries stressed in a joint statement that the EU must accelerate the deployment of wind power to ensure the survival of the bloc’s industrial base.

Meanwhile, industry association WindEurope reported in early July that more than 500 GW of potential wind power capacity in France, Germany, Italy, Spain, Poland, Romania, Ireland, Croatia and the UK are currently awaiting assessment of their application to connect to the grid.

The association noted that gaining access to the grid is currently the biggest obstacle to the expansion of renewable energy in Europe. European power grids are being modernized too slowly, and due to sluggish and imperfect permitting procedures in many countries, some projects are waiting up to nine years. In turn, a surge in solar power production in Europe has hit prices, outlining storage needs.

According to the Eurelectric industry association, in January-June of this year, 74% of electricity in the EU was produced using sources without carbon emissions (50% – solar and wind power plants, 24% – nuclear).