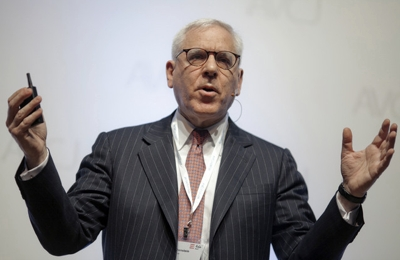

The market is waiting for a correction against the background of the expected strengthening of the Fed’s monetary policy and high inflation. This opinion was expressed by billionaire David Rubenstein in an interview for Bloomberg.

The S&P 500 index has already fallen nearly 5% from its all-time high reached on January 4, 2022, and the NASDAQ technology index has tumbled 10.5%. Rubenstein believes that this is the beginning of a downward trend correction.

The expert noted that the US economy is “generally in good shape,” but with the Fed predicting about four to five rate hikes in 2022, market price cuts are inevitable.

Rubenstein added that inflation should normalize to 3-4% in 2022, “but it’s still double what it was before, and a lot of people are nervous about that.”

“I think this (market fall) will continue as long as we have the coronavirus and supply chain issues,” the billionaire concluded.

On January 18, the American stock index S&P 500 fell by 1.84%, falling to the level of 4,577 points.